Jubilant Pharmova - Q3 & 9M’FY26 results

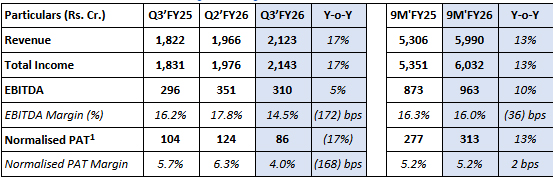

Solid revenue growth of 17% on the back of Line 3 in CDMO sterile Injectables

EBITDA margins to expand going forward as production stabilizes at Montreal facility and revenue ramps up at Spokane facility of CDMO Sterile Injectables business

1. Normalised PAT is after adjusting for exceptional items and corresponding tax.

The Board of Jubilant Pharmova Limited met today to approve financial results for the quarter and nine months ended Dec 31, 2025.

Commenting on the Company’s performance in Q3’FY26, Mr. Shyam S Bhartia, Chairman Jubilant Pharmova Limited and Mr. Hari S Bhartia, Co-Chairman & Non-Executive Director, Jubilant Pharmova Limited said, “We are pleased to announce revenue of Rs. 2,123 Cr. for Q3’FY26, which reflects a solid growth of 17% on YoY basis. Revenue growth is particularly driven by incremental revenue generation from the new & third line in CDMO Sterile Injectable business. We expect this growth momentum to continue as we make progress in the last quarter of current financial year. EBITDA for the period grew by 5% YoY to Rs. 310 Cr. due to improved performance in CDMO Sterile Injectables and CRDMO business. Normalised PAT for the quarter stood at Rs. 86 Cr. As we are consciously investing in Radiopharma, CDMO Sterile Injectables and CRDMO business to secure future growth, Net Debt / EBITDA remains range bound at 1.3x in Dec’25, lower from 1.5x in Sep’25.

During Q3’FY26, we saw exceptional growth momentum in the Ruby-Fill® installs. In the Allergy Immunotherapy business, we witnessed increase in demand from the US market. In the CDMO Sterile Injectables business, we ramped up revenue generation from technology transfer programs at Line 3 in Spokane. In the CRDMO business, we continue to invest in building CDMO capabilities. In the Generics business, we are foreseeing growth & profitability improvement. Lastly, in our Proprietary Novel drugs business, we continue to make progress in JBI-802 and JBI-778 clinical trials.

During the quarter, we witnessed a decline in EBITDA margins, primarily due to the temporary shutdown of our CDMO Sterile Injectables facility in Montreal for remediation following FDA observations. Production has resumed at our Montreal site in Q4’FY26. We anticipate EBITDA margins to strengthen going forward, effectively offsetting higher depreciation costs and driving net profit growth.”

9M’FY26 Financial Highlights

- Revenue grew by 13% on a YoY basis to Rs. 5,990 Cr. on the back of growth in revenue across all business segments.

- EBITDA grew by 10% on a YoY basis to Rs. 963 Cr. due to improved performance across all business segments.

- Normalised PAT increased by 13% on a YoY basis to Rs. 313 Cr. on the back of improved operating performance and reduced finance cost. Reported PAT in 9M’FY25 at Rs. 685 Cr. was higher because of one-time net exceptional income of Rs. 382 Cr.

Segmental Business Performance

Radiopharma - Leading Radiopharmaceutical manufacturer & 2nd largest Radiopharmacy network in the US

Radiopharmaceuticals Q3’FY26 revenue grew by 12% to Rs. 298 Cr. and EBITDA for the quarter stood at Rs. 122 Cr. The business continues to maintain a strong position in the high margin SPECT imaging product portfolio. In the Ruby-Fill® as we can demonstrate superior value proposition against competition, we are able to attract new channel partners. Our Ruby-Fill® install base has grown by 37% in 9M’FY26 on an annualised basis vs 21% in FY25. This improved scale is also helping to increase EBITDA margins in this product category. We are on track to introduce multiple new products in the PET and SPECT imaging from FY27 to FY29. The dosing for Phase 2 clinical trial for MIBG is complete and we are preparing data package to be submitted to FDA latest by Jun’26.

Radiopharmacy Q3’FY26 revenue grew by 11% YoY to Rs. 637 Cr. EBITDA margins for Q3’FY26 stood at 1%. EBITDA margins remained weak due to increased competitive intensity in the SPECT business. Last year, two of our PET radiopharmacies have started distributing PYLARIFY®, which is an industry leading prostate cancer diagnostic imaging agent. We continue to see increase in revenue from PET radiopharmacies. We have also started distributing Pluvicto, which is a leading radiopharmaceutical to treat Prostate cancer.

The proposed investment of US$ 50 million in PET radiopharmacy network is underway. This investment will take the overall PET radiopharmacy network to Nine (9) sites, thereby solidly positioning Jubilant Pharmova’s radiopharmacy network as the second largest in the US and shall drive the future business growth.

Allergy Immunotherapy - No. 2 in the US Sub-Cutaneous allergy immunotherapy market

As the sole supplier of Venom in the US, the business is expanding the overall market by increasing customer awareness. In the US Allergenic extracts, the business is working to increase revenues. The business is also working to increase penetration in the outside US markets.

In Q3’FY26, revenues grew by 12% to Rs. 193 Cr., driven by strong growth in the US & outside US markets. EBITDA remained flat YoY at Rs. 49 Cr. The QoQ decline in EBITDA was primarily due to lower production during the quarter. With production picking up now, we expect to recover the margin gap in Q4’FY26 to deliver normalized margins on a full year basis.

CDMO Sterile Injectables - Leading contract manufacturer in North America, serving top global innovators

Q3’FY26 revenue grew by 49% to Rs. 457 Cr. due to incremental revenue from ongoing technology transfer programs in Line 3. EBITDA grew by 31% on YoY basis to Rs. 68 Cr. EBITDA margins were lower YoY due to shutdown at Montreal facility on account of remediation post FDA observations. Production has resumed at the Montreal facility in Q4’FY26.

In 9M’FY26, EBITDA margins for the Spokane facility stand at 25%. However, the temporary shutdown of the Montreal facility for two quarters, coupled with higher remediation-related costs, has led to lower overall business segment margins to 18% for the nine-month period.

As we move into FY27, we expect to increase EBITDA substantially, supported by a structured costreduction program at the Montreal facility. Our target is to achieve EBITDA breakeven at the Montreal site by FY28. In the medium term, we anticipate that the new isolatorbased fillandfinish line (Line 5) will start generating revenues from FY29 onwards, thereby supporting future growth.

The capacity expansion program at our Spokane, Washington facility remains on track. Following the launch of our third Sterile Fill & Finish line (Line 3) in Q2’FY26, we are successfully ramping up revenues from technology transfer programs. Currently, 6+ products across multiple formats and vial sizes are undergoing technology transfer on Line 3. Commercial batch production is expected to commence in late FY27, subject to FDA approval of these products.

In light of the new tariffs imposed by the US Government, large innovator pharmaceutical companies are increasingly seeking highquality, USbased manufacturing, specifically, those with significant capacities with isolator technology. As a result, we are seeing strong traction in Requests for Proposals (RFPs) for the new lines. The next phase of capacity expansion—Line 4—is also progressing as planned. We expect Line 4 to start generating technology transfer revenues by Q4’FY27.

CRDMO - Indian leader for integrated drug discovery & formidable API player

In Q3’FY26, the Drug Discovery business revenue grew by 13% to Rs. 169 Cr. Revenue continues to increase due to increase in revenue from large Pharma customers. EBITDA margins for Q3’FY26 stand at 26%. EBITDA margins are higher on QoQ basis due to improved revenue mix towards CDMO business. In the short term, we expect competitive intensity to increase in the largepharma customer segment, while demand conditions in the biotech segment are expected to improve. In the medium term, we expect to deliver healthy revenue growth & steady margins.

In the API business, revenue for Q3’FY26 stood at Rs. 129 Cr. EBITDA for the quarter stood at Rs. 18 Cr. EBITDA margins are flat YoY despite decrease in revenue due to profitable product mix. 9M’FY26 EBITDA margins improved by 280 bps to 15%. We have completed the sale and transfer of API Business to Jubilant Biosys Limited, a wholly owned subsidiary of the Company. This transaction has resulted in housing of the drug discovery business and CDMO API business in a single business entity. This combined platform will improve the operational efficiency in the business and lead to superior brand recall of “Jubilant Biosys Limited” as provider of end-to-end CRDMO services by the large pharmaceutical & Biotech customers. The transaction will also help to improve asset utilisation of API business by improving the revenue mix towards Custom manufacturing & CDMO.

Generics - Building a growing, profitable & agile business model

In Q3’FY26, the Generics business revenue grew by 13% to Rs. 226 Cr. EBITDA for the period stood at Rs. 26 Cr. In 9M’FY26, EBITDA margins increased by 150 basis points to 9%. The business has been profitable for the past three quarters and has now begun to show growth momentum. Looking ahead, we expect sustained progress toward the Generics Vision 2030 shared previously.

We plan to launch 6 to 8 products per annum in our US and non-US international markets. In line with our plan, we are ramping up exports to the US markets in a meaningful and gradual manner. We have also started supply of products from our Contract manufacturing partners to the US market.

Proprietary Novel Drugs - Innovative biopharmaceutical company developing breakthrough therapies

The global clinical trials for our lead programs, Phase II trial for JBI -802 for Essential Thrombocythemia (ET) and other Myeloproliferative Neoplasms (MPN) and Phase I trial for JBI -778 for non-small cell lung cancer (NSCLC) and high grade Glioma are actively enrolling patients and progressing in line with our expectations.

About Jubilant Pharmova Limited

Jubilant Pharmova Limited (formerly Jubilant Life Sciences Limited) is a company with a global presence that is involved in Radiopharma, Allergy Immunotherapy, CDMO Sterile Injectables, Contract Research Development and Manufacturing Organisation (CRDMO), Generics and Proprietary Novel Drugs businesses. In the Radiopharma business, the Company is involved in the manufacturing and supply of Radiopharmaceuticals with a network of 45 radiopharmacies in the US. The Company’s Allergy Immunotherapy business is involved in the manufacturing and supply of allergic extracts and venom products in the US and in some other markets such as Canada, Europe and Australia. Jubilant Pharmova Limited through its CDMO Sterile Injectables business offers manufacturing services including sterile fill and finish injectables (both liquid and lyophilization), full-service ophthalmic offer (liquids, ointments & creams) and ampoules. The CRDMO business of the Company includes the Drug Discovery Services business that provides contract research and development services through two world-class research centers in Bengaluru and Noida in India and one in France. The CDMO-API business that is involved in the manufacturing of Active Pharmaceutical Ingredients. Jubilant Therapeutics is involved in the Proprietary Novel Drugs business and is an innovative biopharmaceutical company developing breakthrough therapies in the area of oncology and auto-immune disorders. The Company operates multiple manufacturing facilities that cater to all the regulated markets including USA, Europe and other geographies. Jubilant Pharmova Limited has a team of around 5,500 multicultural people across the globe. The Company is well recognised as a ‘Partner of Choice’ by leading pharmaceuticals companies globally.

For more information, please contact:

Disclaimer

Statements in this document relating to future status, events, or circumstances, including but not limited to statements about plans and objectives, the progress and results of research and development, potential product characteristics and uses, product sales potential and target dates for product launch are forward-looking statements based on estimates and the anticipated effects of future events on current and developing circumstances. Such statements are subject to numerous risks and uncertainties and are not necessarily predictive of future results. Actual results may differ materially from those anticipated in the forward-looking statements. Jubilant Pharmova may, from time to time, make additional written and oral forward looking statements, including statements contained in the company’s filings with the regulatory bodies and its reports to shareholders. The company assumes no obligation to update forward-looking statements to reflect actual results, changed assumptions or other factors.